Calculate take home pay georgia

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. How to calculate annual income.

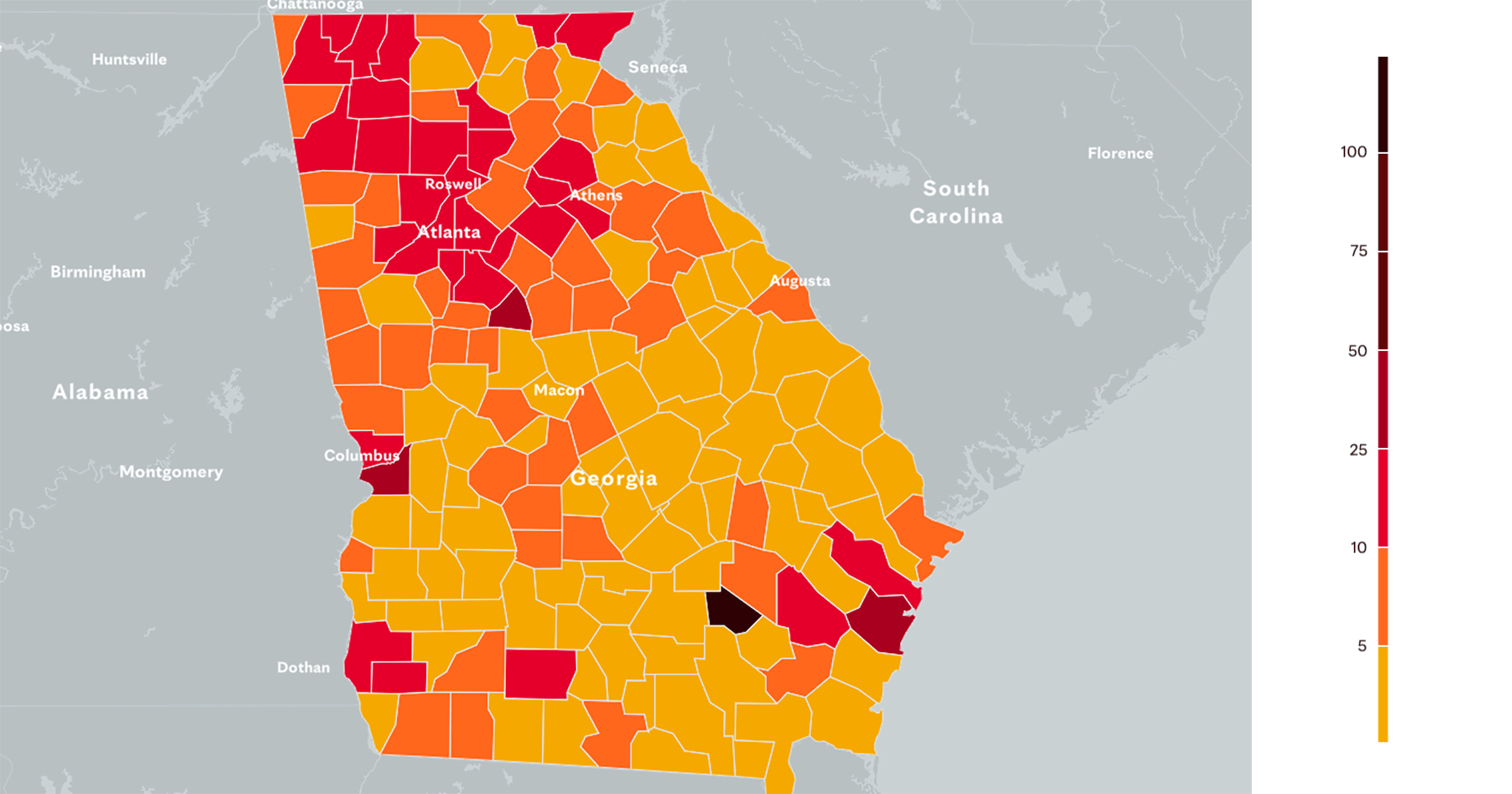

Georgia Coronavirus Map And Case Count The New York Times

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. Well do the math for youall you need to do is enter. For 2022 the minimum wage in Georgia is 725 per hour.

This free easy to use payroll calculator will calculate your take home pay. Hourly Paycheck Calculator Templates 10 Free Docs Xlsx. For example if an employee earns 1500.

For example if an. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Ad Payroll So Easy You Can.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. There is no local tax for Georgia residents therefore this calculator calculates Federal income tax social security tax medicare tax and state tax.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. It can also be used to help fill steps 3 and 4 of a W-4 form. Some states follow the federal tax.

Georgia has their minimum wage rate set at 515 but. Georgia Salary Paycheck Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Georgia Hourly Paycheck Calculator. For example if an employee receives 500 in take-home pay this calculator can be. You can alter the salary example to.

Employers also have to pay a matching 62 tax up to the wage limit. Just enter the wages tax withholdings and other information required. This 10000000 Salary Example for Georgia is based on a single filer with an annual salary of 10000000 filing their 2022 tax return in Georgia in 2022.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For 2022 the minimum wage in Georgia is 725 per hour. As per the Fair Labor Standard Act FLSA An employee whose salary is below 684 per week is eligible for overtime pay.

A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. Take home pay calculator georgia. Medicare tax which is 145 of each employees taxable wages up to 200000 for the year.

Related Take Home Pay Calculator. Supports hourly salary income and multiple pay frequencies. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. Take home pay calculator GA. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State.

The state tax year is also 12 months but it differs from state to state. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Georgia Paycheck Calculator Smartasset

Hourly Paycheck Calculator Calculate Hourly Pay Adp

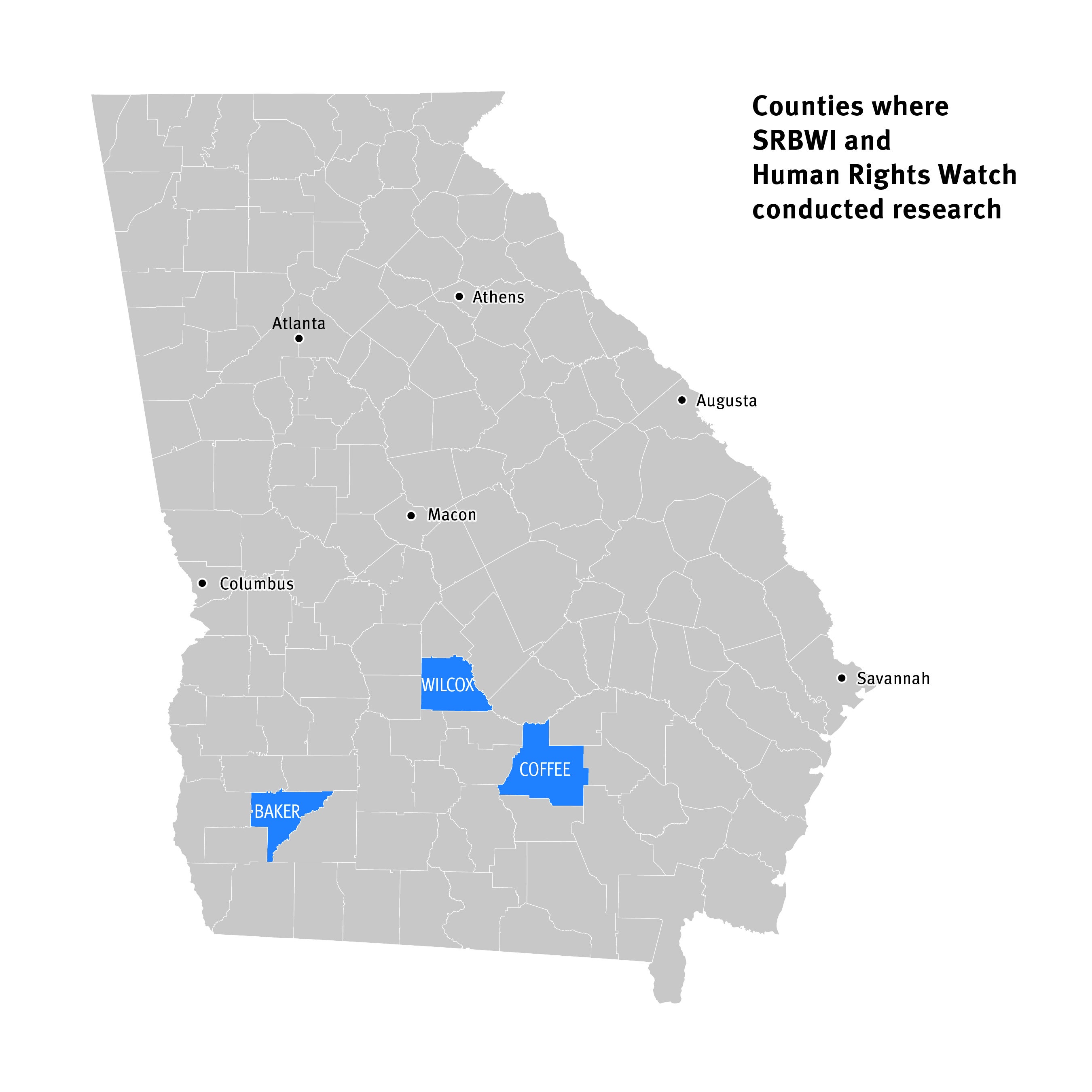

We Need Access Ending Preventable Deaths From Cervical Cancer In Rural Georgia Hrw

Sales Tax On Grocery Items Taxjar

University Of Georgia

Georgia Paycheck Calculator Smartasset

Georgia Sales Tax Guide And Calculator 2022 Taxjar

Georgia Traveler View Travelers Health Cdc

2

Georgia Coronavirus Map And Case Count The New York Times

Georgia Income Tax Calculator Smartasset

Georgia Income Tax Calculator Smartasset

Georgia Covid 19 Map Tracking The Trends

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Gross Pay Vs Net Pay What S The Difference Adp

The Best Places To Retire In 2021